Abstracts:

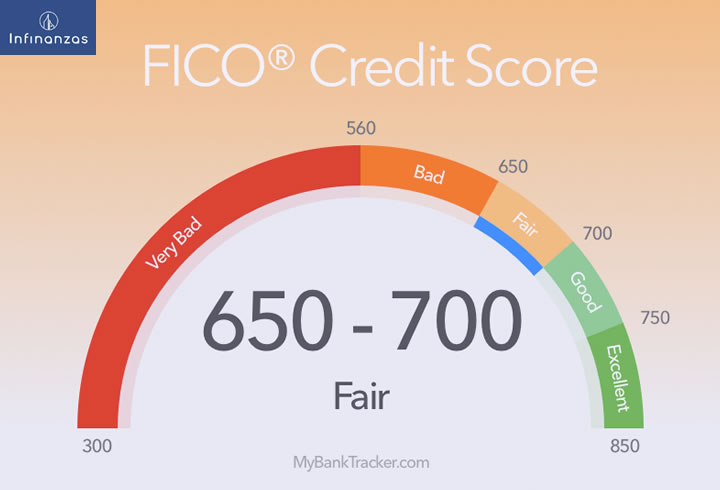

FICO scores are used by some lenders to help determine your likelihood of paying bills on time.

FICO has many different scoring models

FICO scores are calculated using information from your credit reports.

Fair Isaac Corporation created FICO scores. There are many different versions of FICO scores based on different scoring models. FICO scores use the information in your credit report to help determine your likelihood of paying bills on time. Lenders often use FICO scores to help decide whether to extend credit to consumers.

FICO scores, as well as credit scores that other companies calculate using different models, can predict similar types of risk. It is important to remember that because different FICO and other credit scores were created using different scoring models, the scores may not be identical. Different credit scoring models have different formulas and calculations (often called algorithms) that use data differently to help predict the likelihood that a person will pay bills on time.

Although FICO has many different scoring models, it uses relative percentage weights to help determine how much impact certain factors will have in helping to determine a FICO credit score. The main categories considered are a person’s payment history (35%), amounts owed (30%), length of credit history (15%), new credit accounts (10%) and types of credit used (10%).

FICO scores are available from each of the three major credit bureaus based on information contained in consumers’ credit reports. Because there are different FICO scoring models and different credit bureaus, consumer credit scores may differ depending on which bureau’s credit report and which FICO scoring model is used.